Page 51 - CMA Journal (Sep-Oct 2025)

P. 51

Focus Section

Empowering SMEs through

Finance and Technology

Author: Co-Author

Abbas Raza Varayla Maria Shahab

Senior International Trade, Educationist and

Islamic Finance and Trainer at Dastak

Compliance Expert Teachers Training

(The Citizen

Foundation)

Small and Medium Enterprises (SMEs) are recognized as total exports. The sector also employs an estimated 80%

the backbone of an economy and the heartbeat of of the non-agricultural labor force in Pakistan. Despite

communities. As noted by ‘Small and Medium Enterprises their significance, SMEs only receive 6-7% of private

(SMEs) Finance – World Bank’: sector financing (Enhancing the Economic Efficiency of

Small and Medium Enterprises in Pakistan- Competition

“In developing countries, SMEs are central to economic

Commission of Pakistan, 2023).

diversification, productivity, and poverty reduction. Yet, they

face persistent challenges in obtaining the financing SME Provincial Contribution

needed to start, sustain and grow.”

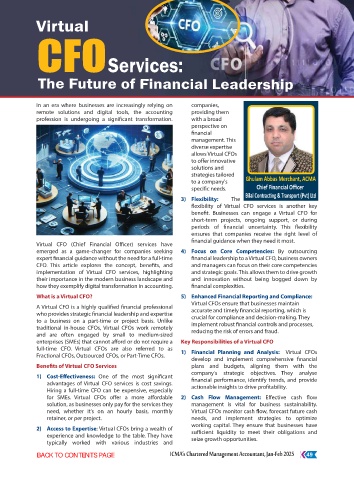

Small and medium enterprises’ growth is critical to 9%

Pakistan’s economic development along with 5%

broadening trade. However, barriers such as high credit

costs, insufficient collateral, and low digital adoption

24%

have restricted their contribution to GDP. The State Bank

62%

of Pakistan (SBP), as the authoritative financial institution,

has implemented a comprehensive framework which

incorporates finance through targeted refinancing, risk

coverage, and subsidized lending along with technology

Punjab Sindh

and digital supply chain finance (DSCF), e-guarantees, Khyber Pakhtunkhwa Balochistan, Gilgit, FATA

and fintech. The State Bank of Pakistan’s initiatives within

the prudential regulatory framework highlight their 1) SME Provincial Contribution

expected impact on SME growth, which is backed by

Punjab and Sindh are densely populated provinces.

empirical data and policy references.

Punjab, due to a more concentrated population, is the

The SME sector is the cornerstone of Pakistan’s economy, undisputed leader in Pakistan’s SME sector, followed by

constituting around 40% of GDP, employing nearly 80% Sindh, largely due to the presence of the capital city,

of the non-agricultural labor force, and contributing Karachi. As per the State Bank of Pakistan in 2024, despite

around 25% of manufactured exports (Small and Medium this significant contribution, SME access to formal finance

Enterprises Development Authority- SMEDA, 2023). has historically remained below 6% of private sector

credit. SBP acknowledged this gap and has prioritized

“With over 5.2 million SMEs in Pakistan, the sector

SME financing as a core pillar of inclusive economic

represents approximately 90% of businesses,

growth.

contributing 40% to the country’s GDP and 30% to the

ICMA’s Chartered Management Accountant, Sep-Oct 2025 49