Page 34 - CMA Journal (Sep-Oct 2025)

P. 34

Focus Section

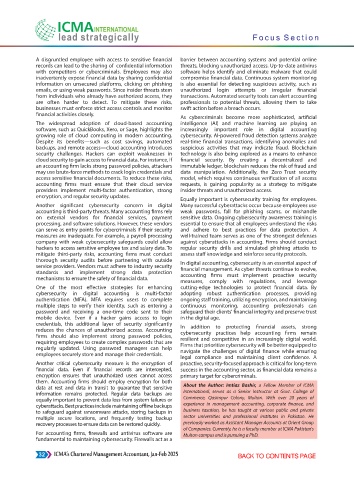

Electricity bill - to generate revenue Chart 4: Tariff Across DISCOs (PKR/kWh)

NEPRA Determined Tariff Uniform Average Tariff

Electricity bills often pose challenges for consumers

due to various levies, duties, and surcharges that

increase their financial burden. These bills have

become a vehicle for the Federal Board of Revenue 34.0

(FBR) to collect taxes.

44.4 44.9

37.2 41.5 35.5

A surcharge of Rs. 3.23 per kWh (up from Rs. 0.23 per 29.3 31.2 32.7 33.8 34.7 33.5

kWh last year), intended to address interest payments

on CD held in PHPL and now, under the new plan, to

IESCO LESCO FESCO GEPCO MEPCO PESCO HESCO QESCO SEPCO TESCO HAZECO

assist in repaying bank loans, shifts risks from utility

Source: NEPRA Tariff Determination, July 01, 2025.

operators to consumers. This increases costs for

compliant users and can potentially lead to

inefficiencies in the distribution system. The imposition Consumers can only benefit in terms of service quality

of excessive taxes on electricity bills further aggravates and affordability when there is competition in the

the existing challenges faced by the electricity market. Competition will not exist if inefficient and

distribution sector. efficient DISCOs are treated the same and charged a

uniform tariff. Switching from a uniform tariff to

Lack of transparency differentiated rates across distribution companies will

boost efficiency, as tariffs will reflect the actual service

Apart from variations in cross-subsidies, fixed charges are

incorporated without being clearly requested by DISCOs costs in different regions.

in their petitions. Some of these amounts are not clarified Improving governance in DISCOs and implementing

during public hearings but are still included in the final tariff reforms are crucial for reducing financial leakages,

tariff notifications. Industrial stakeholders have expressed enhancing utility performance, and promoting a

concerns about the unpredictability of FCAs, noting that consumer-centric power sector.

NEPRA data is often inaccessible and incomplete.

References

Conclusion • Malik, A. and Ali, F. (2025). Fixing grid woes. Retrieved from The News

International: https://www.thenews.com.pk/latest/1341369-fixing-

In Pakistan, Circular Debt stems from deep-rooted grid-woes.

governance issues, operational inefficiencies, and • Malik, A. and Mustafa, G. (2024). Power Sector Debt and Pakistan’s

ineffective policies. The simplistic approach of merely Economy. PIDE Working Paper 2024:2.

increasing tariffs or injecting funds overlooks the • Ali, F. (2025). Can power sector finally turn a corner? Retrieved from

Business Recorder: https://www.brecorder.com/news/40384556/

complex realities of the sector's challenges. Although can-power-sector-finally-turn-a-corner.

policymakers attempt to manage rising tariffs through • BR Research. (2025). Déjà Vu for the trade balance. Retrieved from

subsidies and cross-subsidies, financial constraints make Business Recorder: https://www.brecorder.com/news/40386154.

subsidies no longer feasible, and cross-subsidies are • Cheema, T, B., Haque, N., and Malik, A. (2022). Power Sector: An

Enigma with No Easy Solution. PIDE-RASTA book.

distortionary, further worsening the CD problem.

• Ali, F. and Ijaz, A. (2025). Kafkaesque debt spiral. Retrieved from The

The tariff structure in Pakistan is primarily shaped by News International:

https://www.thenews.com.pk/latest/1347081-kafkaesque-debt-spiral

political factors rather than actual costs. Implementing

• Malik, A. (2020). Circular Debt—An Unfortunate Misnomer. PIDE

MC-based pricing for all consumers would ensure they Working Paper Series 2020:20.

pay based on the actual cost of electricity supply to them, • Malik, A. (2025). Unplug the fiscal leak. Retrieved from The News

maximizing revenue and reducing inefficiencies. International: https://www.thenews.com.pk/latest/1334271-

unplug-the-fiscal-leak.

Eliminating tariff-based subsidies and cross-subsidies is • Rana, S. (2025). Govt resists Rs200b circular debt cap. Retrieved from

vital for fiscal discipline. Given the excess capacity and Tribune: https://tribune.com.pk/story/2571211/govt-resists-

declining demand, managing consumption through MC rs200b-circular-debt-cap

• Malik, A. Mustafa, G., and Zia, U. (2023). Energy Reforms for Export

pricing can ensure financial sustainability and improve

Oriented Units in Pakistan. PIDE Research Report.

industrial competitiveness.

About the Authors: Afia Malik is a researcher and energy

Removing subsidies from the power system requires a expert with more than thirty years of experience at the Pakistan

strong support mechanism for vulnerable populations. Institute of Development Economics (PIDE), Islamabad.

The Benazir Income Support Program (BISP) effectively

Furqan Ali is a Peshawar-based freelance researcher and writer

provides targeted financial assistance, ensuring help

covering governance, economy, gender, climate, and literature.

reaches those in need while minimizing leakage through

He co-founded Policy Club and serves as an Advisory Associate

transparent, data-driven identification methods. at Zahid Jamil & Co.

32 ICMA’s Chartered Management Accountant, Sep-Oct 2025